Hello, good to come your way again on the topic “reason for financial intelligence”. This topic is so crucial that it cannot be over emphasized. As I take you through this path, I want you to open up your mind to learn in a different way. Financial freedom is achievable and possible when you make it your goal.

- You must have the right financial goals. If you look at the diagram below it is very confusing, the arrows are drawn into different directions. Unfortunately many of us fall into this path. Your goal should be financial freedom and not security. Financial security says you want to secure yourself; very quickly you want to buy a car so that you can drive yourself around, you need a job with security, and you want to build your house so that you will be free from landlord problems. While financial freedom says how can I gather things that can generate passive income? Where I don’t have to exchange my time and energy for money to become financially free.

- How much do you want to earn this year? You have to state clearly in your workbook how much you want to earn, how many streams of income you intend to have, and what is your goal for all of them? This goal needs to be reached by adding together all the streams; it’s a number for the year. Once the year is clear, you now need to set it monthly and weekly and review as you go.

- Budgeted expense goal: Many are not in control of their expenses, hence not able to make reserves, nor plan for their future. How much will you spend this year? Monthly regular necessity expense may be $1000, multiply it by 12 for the year’s goal. You pay rent in bulk, you want to buy a car, you want to go on a vacation, you want to plan and support others. These bulk values are going to manifest on your expense column. Add them all together to get your yearly expense figure. This better be less than 50% of your income!

- Escrow reserve or asset goal: How much cash asset are you reserving this year? What will be the size of your escrow account by year end? (An escrow account is a third party account governed by rules and regulations which helps you to build reserves for your future). How many passive income generating assets will you have? Set big goals, the more consistent you become, the more income opportunities that will come your way.

- Liability goals: How many liabilities do you want to have? Are your liabilities capable of generating cash or do they keep taking money from you?

If you don’t have clear goals about your finances then you are not planning to be free. Once you set the sails God will send the wind.

“Our plans miscarry because they have no aim. When a man does not know what habour he is making for, no wind is the right wind”. Seneca

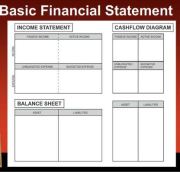

- You need to take your current financial snapshot in order to track and monitor your financial growth. This should consist of the following:

Income Statement

- Passive income

- Active income

- Budgeted expense

- Unbudgeted expense

Balance Sheet consists of:

- Asset column

- Liability column

- Cashflow Diagram

Below is a diagrammatic representation of a simple financial statement

If you do not have a resource that generates passive income then you don’t have an asset. If you live in your own house whereby you don’t earn rental income, you don’t have an asset because at one time or the other you will carry out maintenance repairs and that takes money away from you.

Ignorance of once ignorance is the minimum qualification required for admission into the college of fools.

Acquire financial intelligence today, keep your eye on your financial score card and see your life transform dramatically. This means that academic and professional intelligence cannot earn you financial freedom.

I’m committed to your success!

Charles Ezeh

Be wise, be financially free!!!

Categories: Financial Intelligence

Thank you for sharing your info. I trupy appreciate your efforts and I will be waiting for your further

post thanks ohce again.

Hello, I enjoy reading all of your article. I wanted to write a little

comment to support you.

Thanks on your marvelous posting! I genuinely enjoyed reading

it, you can be a great author.I will always bookmark your

blog and definitely will come back from now on. I want to encourage that you

continue your great job, have a nice evening!

My brother recommended I might like this

web site. He was entirely right. This post actually made my day.

You can not imagine just how so much time I had spent for

this information! Thanks!

Excellent, what a blog it is! This webpage presents valuable information to us,

keep it up.

Hi there, just became alert to your blog through Google, and found that

it’s truly informative. I’m gonna watch out for brussels.

I will appreciate if you continue this in future.

Lots of people will be benefited from your writing.

Cheers!

It’s remarkable to visit this website and reading the views of all friends regarding this post, while I am also zealous of getting familiarity.

This is very interesting, You’re an excessively professional blogger.

I have joined your rss feed and stay up for seeking more of your magnificent post.

Additionally, I’ve shared your website in my social networks

Hi! Do you know if they make any plugins to safeguard against

hackers? I’m kinda paranoid about losing everything I’ve

worked hard on. Any recommendations?

Don’t know any for now.

Hurrah! At last I got a website from where I be capable of actually obtain valuable facts regarding my study and knowledge.